04:13 PM

4 Takeaways From Caplin's Mobile Trading Study

The latest whitepaper from the trading technology firm Caplin Systems recalls the time when retail banks first added payment and transfer functionalities to mobile apps. Previously, bank apps only gave account balance and recent transaction data, and it was questioned if users would feel comfortable enough to make financial transactions on mobile. The results spoke for themselves; app adoption soared, as did the number of mobile payments customer made.

Retail banks then offered the ability to trade securities on mobile. Again, it was a success, becoming a vital part of trade flow for many banks. The quesiton was then asked, would financial trading by professionals be equally appealing on mobile? Surely professional trading is an activity limited to the desktop?

Once more, the results speak for themselves:

While the appetite and opportunity for mobile trading certainly varies by client segment, our research shows a high proportion of buy-side participants in the markets are just as keen to trade on their mobiles as they are to answer emails on them or pay bills on them. And banks that have aggressively rolled out mobile execution offerings worldwide have seen rapid adoption with few regulatory issues.

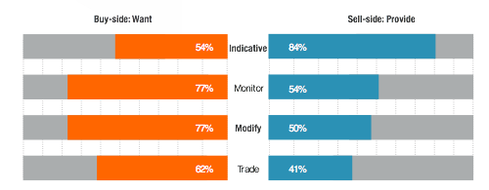

The survey further revealed "dramatic gaps between what the buy-side wants and what the sell-side offers." The following chart compares buy-side wants (indicative pricing/research, monitor positions, manage positions, and enter new orders/execute trades) with what the sell-side currently provides.

Becca Lipman is Senior Editor for Wall Street & Technology. She writes in-depth news articles with a focus on big data and compliance in the capital markets. She regularly meets with information technology leaders and innovators and writes about cloud computing, datacenters, ... View Full Bio