04:13 PM

4 Takeaways From Caplin's Mobile Trading Study

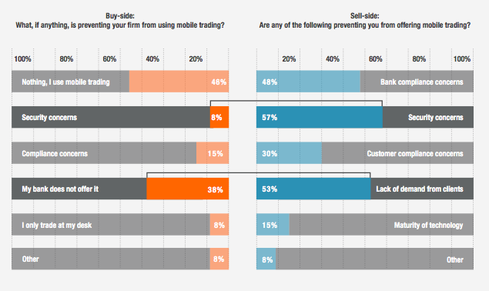

When it comes to mobile execution services, Caplin says, "The issues that we encounter in this area are almost always more to do with uncertainty than any actual problem." Indeed, Caplin took great pleasure in breaking down and largely discrediting the top reasons banks and traders haven't yet launched or used a mobile trading application.

Among the most popular concerns were that security and compliance issues would make mobile trading too difficult to manage and monitor.

The firm argues security considerations for mobile are the same for the web, and considerably easier to implement because mobile devices have more modern software. Lost devices can be shut down remotely, and two factor identification helps assure trading tools are not in the wrong hands.

From a regulatory standpoint, "Issues associated with mobile trading are actually not especially difficult." Furthermore, "We have not been able to find any regulatory domains in which voice trading is permitted from a mobile phone but electronic trading is not. In fact the level of security and safety around an electronic trade submitted from a mobile is considerably greater that that for a voice trade."

As long as trading activity is recorded, it does not matter on which medium the trade is executed.

Becca Lipman is Senior Editor for Wall Street & Technology. She writes in-depth news articles with a focus on big data and compliance in the capital markets. She regularly meets with information technology leaders and innovators and writes about cloud computing, datacenters, ... View Full Bio