06:15 AM

Where Should You Spend Your IT Budget in 2015?

I have been on the distribution list for the McKinsey Quarterly for some time. The articles are always interesting, but with topics such as "Business, society and the future of capitalism," they don't always provide useful insight for regular folks like me. So I was pleased to receive the latest McKinsey update, How Winning Banks Refocus Their IT Budgets For Digital.

"Banks urgently need to digitize their businesses, but they should invest selectively in areas where recent research indicates

the best payoff."

— McKinsey & Co.

A concrete analysis based on data from McKinsey Horizon360's annual survey of retail, corporate, and investment bank spending for IT in Europe, the report provides some potentially useful insight into

Wall Street & Technology's Capital Markets Outlook 2015

Here are 10 topics that will be a focus for financial institutions in 2015 and beyond:

- Technology Innovation Returns to Financial Services

- Global Banks Need to Demonstrate RDA Progress in 2015

- Where Should You Spend Your IT Budget in 2015?

- Financial Firms to Struggle With Growing Social Infrastructure in 2015

- As Market Matures, Fintech Startup Winners Will Emerge in 2015

- Universities Increasing Programs for Data Scientists

- Next Year, Aim for Communication & Clarity of Cloud Apps

- E-Trading Disruptors Seek Untapped Liquidity in Corporate Bonds

- Swap Markets Debate Anonymous Trading in SEFs

- The Clock For Market Structure Change Is Ticking

- Increasing Cyberthreats Pose Massive Challenge for Financial Firms

correlations between spending and bank profitability. However, the authors are right to point out that the data shows only correlation, not causation.

Among the observations included in the report:

- The more profitable banks are investing in "product back-office automation, digitization of document management and automation of credit decisions, and big data analytics applied to sales campaigns." On average, the profit margins of banks investing in these areas are twice as high as the others.

- "Cost control, rigorous project prioritization, advanced sourcing practices, and relentless standardization of IT infrastructure and application architecture" show a strong correlation with lower spending on day-to-day IT operations. The average savings is 41%.

- Several application development practices are not directly correlated to lower IT spending. They include "frequent software releases, strict adherence to release schedules, and a modular application architecture."

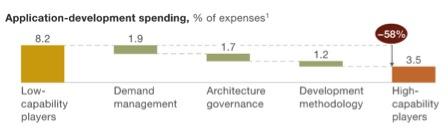

- Application development practices that are related to lower development spending include "effective demand management, centralized application-architecture governance, and use of agile software development." The spending differences are substantial, as shown in this chart taken from the report.

For me, the most unexpected result was the strong correlation between agile development and project success: "Banks that apply agile methodologies to less than a quarter of their projects deliver 70 percent of projects on budget and 55 percent on time. In contrast, banks that use agile in more than half of their projects deliver 96 percent of projects on budget and 79 percent on time."

The authors also note that many of the industry's development process "best practices" don't appear to contribute to reducing application development spending, including "extensive automation of software testing, formalized processes for business involvement, and documentation of business requirements."

All this should be food for thought as you decide your spending priorities for 2015.

Jennifer L. Costley, Ph.D. is a scientifically-trained technologist with broad multidisciplinary experience in enterprise architecture, software development, line management and infrastructure operations, primarily (although not exclusively) in capital markets. She is also a ... View Full Bio