08:20 AM

Strong Recovery of Equity Trading Volumes on Global Exchanges

Equity trading volumes rebounded during the first half of 2014, according to market statistics from the World Federation of Stock Exchanges Ltd. (WFE), which published its Statistics Market Highlights report on Tuesday.

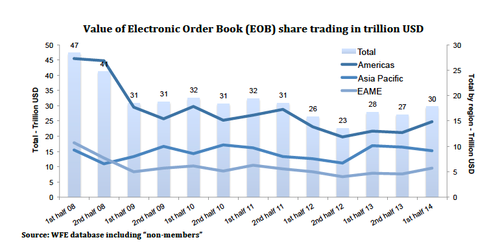

The value of share trading jumped 10% worldwide to US$29.7 trillion from the second half of 2013. Volumes rose 6.8% year-on-year, according to the trade association for the operation of regulated financial exchanges.

During the first six months of this year, exchanges saw increases in the number of trades, as well as in global market capitalization and performance of IPO markets and investment flows.

In sync with the value of share trading, the number of trades also rose 10% globally. The number of trades increased by 39% in the United States, marking the highest increase.

"The numbers are interesting. After several years of decline we are witnessing signs of a recovery in exchange volumes in the recent period” said Grégoire Naacke, Senior Analyst at the WFE. "The IPO numbers mirror this trend. The number of companies coming to market has surged. The question now is whether it will last, said Nacke in the release. “As regulatory mandates begin to take effect will there be a greater shift from OTC to exchange."

One of the main drivers for the recovery of share trading volume is likely the continued strong performance of stock markets, observes WFE. Global market capitalization went up 6% in the first half of 2014, with all regions -- Americas, Asia/Pacific, and Europe, Africa, Middle East (EAME) -- contributing. The Americas led the way with an increase of 8%, followed by Asia/Pacific, up 5%, and EAME, up 3%. Meanwhile, on July 24, the S&P 500 and Dow Jones Industrial Average reached their historical highest levels since the launch of the indices in 1957 and 1984.

The number of regional and global electronic order book trades surged 33.3 % in the Americas, while they increased 16.4% in EAME and declined 1% in Asia/Pacific.

While the number of IPOs fell 11% compared to the second half of 2013, they increased 42% year-over-year. Total investment flows increased 17% over the second half of 2013, decreasing 13% year-over-year.

Other asset classes

Bond trading recovered for the first six months, up 12%, after suffering a 16% decline in the second half of 2013. ETFs increased 7% on the turnover in the first half of 2014 as compared to a 7% decrease in the second half of 2013. The increase in ETF volumes was mainly due to the US, which represents 87% of total turnover. European ETFs are mainly traded off exchanges, according to the WFE.

The recovery of volumes and share values goes along with the improvement in economies and the movement of OTC derivatives onto regulated platforms or exchanges.

"Exchanges serve the real economy every day,’’ commented Hüseyin Erkan, CEO of the WFE. "As volumes recover and companies seek capital to fund themselves, market operators will play an even greater role. The recent concerns have focused investor interest in markets that are transparent and regulated.’’

Volume in exchange-traded derivatives markets remained relatively stable in the first half of 2014. While equity derivatives volumes fell 2.6% that was counterbalanced by the increase in volumes of interest rate derivatives, up 8.6%. While interest rate derivatives benefited from the anticipation of interest rate rises in the US and UK, low levels of volatility diminished the hedging needs of investors. Across the regions, volatility as measured by the S&P 500 Volatility Index (VIX) fell 16% to 11.57, while the Euro STOXX 50 decreased 12% to 15.27, and the Nikkei Stock Average Volatility Index fell 24% to 17.34. Currency derivatives increased 13.3%, but that was offset by a 5.7% decrease of commodity derivatives.

Ivy is Editor-at-Large for Advanced Trading and Wall Street & Technology. Ivy is responsible for writing in-depth feature articles, daily blogs and news articles with a focus on automated trading in the capital markets. As an industry expert, Ivy has reported on a myriad ... View Full Bio