09:00 AM

The OFR�s Latest: 'C Is for Credit'

A new edition of one of my favorite documents has just been released. No, it&'s not the latest Sue Grafton mystery (her latest, by the way, is W Is for Wasted) but the annual report to Congress from the Treasury Deparment's Office of Financial Research (OFR) on the state of the US financial system.

The bulk of the report assesses threats to US financial stability and outlines progress in addressing those threats. As always, I encourage you to read the document. It is well written and approachable. The news is not altogether good. Though overall risks to financial stability are comparable to the pre-crisis period, the OFR identifies three areas in particular where risk has increased over the past year.

- Market risk: "the vulnerability of investor portfolios to large losses because of unanticipated adverse movements in interest rates, exchange rates, and other asset prices"

- Risks among nonfinancial corporations: "relaxed lending standards, lower credit quality, higher debt levels in relation to total assets, and thinner cushions to counteract shocks"

- Market liquidity risks: "in part reflecting structural changes in the way liquidity is provided."

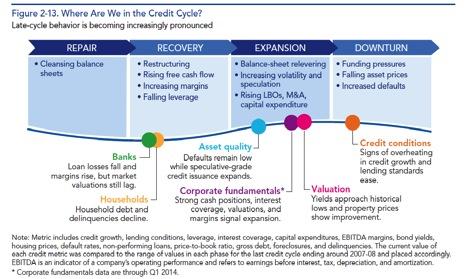

The OFR also provides a rather worrying view that credit risk vulnerabilities have continued to increase unabated. Low interest rates and looser bank lending standards have "encouraged a rapid expansion in corporate credit" and perhaps allowed corporations to take on more debt than they can service. The debt-to-EBITDA ratio is "approaching the peak registered in 2007," the report said. "The quality of new debt issued by companies has also been weaker than in previous credit cycles."

(Image: OFR 2014 Annual Report to Congress)

Along with this debt buildup, the OFR noted increased product innovation (a hallmark of late-stage credit cycles) and increased credit exposure among nonbank lenders and in other areas not directly regulated by banking supervisors. The agency expects a bad outcome as the cycle inevitably turns to downturn once again. "For now, still-strong retained earnings and better liability management help companies mitigate potential refinancing risk. But as the cycle turns from expansion to downturn, the buildup of past excesses will eventually lead to future defaults and losses."

Unlike with a mystery, the open question in this story is not who but when.

Jennifer L. Costley, Ph.D. is a scientifically-trained technologist with broad multidisciplinary experience in enterprise architecture, software development, line management and infrastructure operations, primarily (although not exclusively) in capital markets. She is also a ... View Full Bio