09:05 AM

IT & Business Transformation With Automation

Business process management (BPM) as an industry discipline has been around for over a decade, but only recently have verticals like financial services realized how important it is to business automation. The core ideas around BPM are not that complex or arcane. For the newbies among us -- every enterprise is composed of repeatable business activities done by human actors. These steps are the core of the functioning of the enterprise, indeed they are the very lifeblood. There is significant business value in being able to document, simulate, manage, automate, and monitor business processes.

Financial services are fertile ground for business process automation, since most banks across their various lines of business are simply a collection of core and differentiated processes. Examples are consumer banking (with processes including onboarding customers, collecting deposits, conducting business via multiple channels, and compliance with regulatory mandates such as KYC and AML); investment banking (including straight-through-processing, trading platforms, prime brokerage, and compliance with regulation); payment services; and wealth management (including modeling model portfolio positions and providing complete transparency across the end-to-end life cycle). The key takeaway is that driving automation can result not just in better business visibility and accountability on behalf of various actors. It can also drive revenue and contribute significantly to the bottom line.

Though most large banks do have pockets of BPM implementations that are adding or beginning to add significant business value, an enterprise-wide re-look at the core revenue-producing activities is called for, as is a deeper examination of driving competitive advantage. BPM circa 2014 has evolved into more than just pure process management. Meanwhile, other disciplines have been added to BPM -- which has now become an umbrella term. These include business rules management, event processing, and business resource planning.

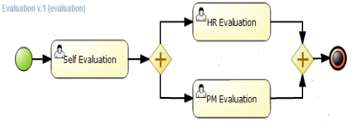

A business process system should allow someone to convey your business process by describing the steps that need to be executed in order to achieve the goal (and explain the order of those steps, typically using a flow chart). This greatly improves the visibility of your business logic, resulting in higher-level and domain-specific representations (tailored to finance) that can be understood by business users and should be easier to monitor by management.

The business rules approach adds another dimension to BPM by enabling the leverage of declarative logic with business rules to build compact, fast, and easy-to-understand business applications. An example of this is in a sector (e.g. trading platforms, mortgage underwriting applications) where market conditions result in changing business rules and business processes.

Although several attempts have already been made, there is not, up until now, any broadly accepted definition of Complex Event Processing (CEP). The term event by itself is frequently overloaded. It can be used to refer to several different things, depending on the context in which it is used.

For instance, on a trading application, when a sell operation is executed, that causes a change of state in the domain that can be observed on several actors, such as the price of the securities that changes to match the value of the operation, the owner of the individual traded assets that are exchanged from the seller to the buyer, or the balance of the accounts from both seller and buyer that are credited and debited. Intercepting a cloud of these events and having a business process adapt and react to them are key to having an agile automation platform.

New Age financial platforms for business process management that are not only to be deployed across physical, virtual, mobile, and cloud environments, but also include complementary paradigms -- business rules and complex event processing (CEP) capabilities -- can add to operational efficiency, new business models, better risk management, and ultimately increased revenue.

As Chief Architect of Red Hat's Financial Services Vertical, Vamsi Chemitiganti is responsible for driving Red Hat's technology vision from a client standpoint. The breadth of these areas range from Platform, Middleware, Storage to Big Data and Cloud (IaaS and PaaS). The ... View Full Bio