10:12 AM

TradeKing Enters the Online Advisory Market

Against the backdrop of market fluctuations, investors also need to maintain discipline, he says. “We’re really dealing with the emotional aspect of managing finances,” he says. “We feel this will help folks that need a little help and guidance.”

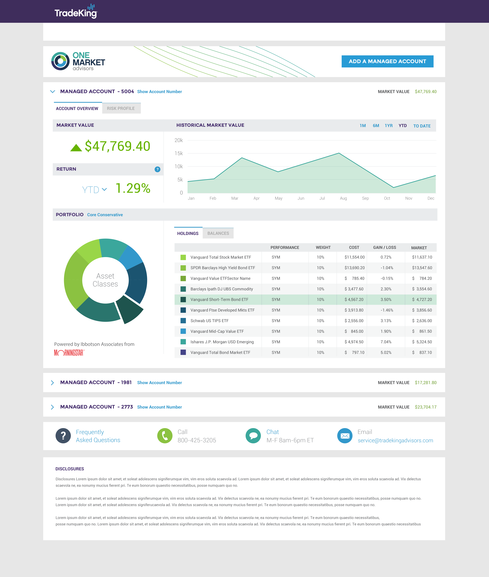

TradeKing Advisors will offer two groups of portfolios: core and momentum groups. Each will contain five portfolios that range from conservative to aggressive, and allocate to a variety of asset classes using a combination of historical and current market data involving risk, return, and correlations.

In the core portfolios, the risk levels are conservative, moderate, moderate growth, aggressive, and aggressive growth. “The risk-level determines the weighting of the ETFs that make up and construct that portfolio,” he says.

Robo-advisers entice established players

To compete with the so-called robo-advisers that are offering automated portfolio management services, TradeKing and other established players are setting up automated portfolio management sites for lower fees. Ameritrade offers Amerivest, a program that now manages $8 billion in AUM. “That is probably the closest to what we are doing. I don’t put us in the bucket of the Betterment or WealthFronts. I feel we are more like the Amerivest offering,” says Hagen.

Vanguard rolled out a program called Vanguard Personal Advisor Services (VPAS) that offers a managed portfolio of (Vanguard) funds/ETFs and access to a designated human financial advisor who is a certified financial planner (CFP) certificant, according to Planning Profession. What is most surprising is “a flat 0.3% AUM fee, with a $100K asset minimum,” wrote Investment News, adding that Vanguard could drop the minimum to $50K.

However, TradeKing Advisors has dropped the minimum account size to $10,000 for the core portfolios and charges a fee of 0.75% annually for a level of service that only the wealthy could once afford. The fee for momentum portfolios is 1% of the account balance annually, with a $25,000 minimum. Fees are reduced by 0.25% for clients with account balances over $250k.

Objective advice

Compared with Vanguard’s offering which recommends Vanguard mutual funds and ETFs, Hagen says that TradeKing is agnostic. “We don’t have product skin in the game. We want to be objective for our clients and provide them the best product at the lowest cost, and that’s one of the drivers in our ETF selection process,” he says.

He says he feels that TradeKing is taking the best of what the robo-advisers are offering with technology and adding portfolio management. Some of the startups like Sig Fig are not brokers. SigFig partners with TradeKing. “They overlay technology on the brokerage relationship,” he says.

“We’re fully automated at the front-end. The platform was designed with a mobile mentality. “Whether you are on a tablet, iPhone, or Droid, it’s going to recognize that device is mobile,” he says.

Drawing on its service expertise, TradeKing will be handling all of the brokerage operations, from electronically opening the accounts, to funding the accounts, to servicing the accounts, to providing tax documentation at year-end.

Ivy is Editor-at-Large for Advanced Trading and Wall Street & Technology. Ivy is responsible for writing in-depth feature articles, daily blogs and news articles with a focus on automated trading in the capital markets. As an industry expert, Ivy has reported on a myriad ... View Full Bio