06:30 PM

BGC Partners Hires Javelin Founder James Cawley to Strengthen Its Offering

As SEF volumes increase and competition heats up, BGC Partners has hired industry veteran James Cawley to serve as chief executive officer of BGC Derivative Markets L.P., the firm's swap execution facility subsidiary.

The move is yet another sign that BGC Partners is moving swiftly to expand its business in swaps trading both organically and through acquisition. On October 22, the interdealer broker started a $675 million hostile bid for GFI Group, a rival New York brokerage and clearing firm.

Cawley was formerly CEO of the SEF Javelin Capital Markets, which he founded in 2009, where he was an early advocate for swaps trading on SEFs. He left Javelin in May of this year.

"I am happy to be in the BGC family," comments Cawley in an interview. BGC has offices around the globe and is a huge force in cash markets and derivatives markets, particularly in interest rate swaps in Europe and euro-denominated swaps located in London.

"I think my talents can be put to good use in terms of mustering the resources of BGC and deploying them the right away," says Cawley. While not commenting on the bid for a rival, he says: "We're as comfortable as building businesses from the ground up as we are as acquiring businesses."

Now with the hiring of Cawley, BGC is positioning the SEF to capture more market share and strengthen its derivatives offerings. "BGC doesn't not like to be in the back of the race, and they're now deploying resources across the board to make sure that happens," he says.

Cawley will assume responsibility for all aspects of BGC's SEF, including spearheading its growth, business development, regulatory compliance, and policy implementation, states the release. He based in New York, and reports to Philip Norton, global head of e-commerce at BGC. In addition, BGC Partners announced that Angelo Toglio, who served as interim CEO of BGC's SEF, assumes the role of chief operating officer.

"My first remit is really to build upon what we have which is a good solid base in the voice context. We have excellent relationships with the banks, but also to really look to the markets and address the customer needs," says Cawley. He notes that BGC has strong electronic DNA with eSpeed, an electronic fixed-income trading platform that was sold to Nasdaq OMX last year. "It was very entrepreneurial in building out that business," he adds.

BGC supports multiple modes of execution both in limit order book and also in RFQ for straight swaps and for various combinations of swaps, curves, butterflies vs. Treasuries. It also has an auction-match proven to be successful in Europe, he says. "As the markets electronify and become really straight through in seamless processing, they're coming at swaps with a fresh pair of eyes and renewed commitment to building it out," he says.

Two weeks ago, BGC Partners hired trading technology veteran Eric Hirschhorn, who brings expertise in fixed income, currency, and commodities (FICC) for the role of chief information officer.

For more information on BGC Partners' new CIO, read BGC Partners Hires Trading Tech Veteran as CIO.

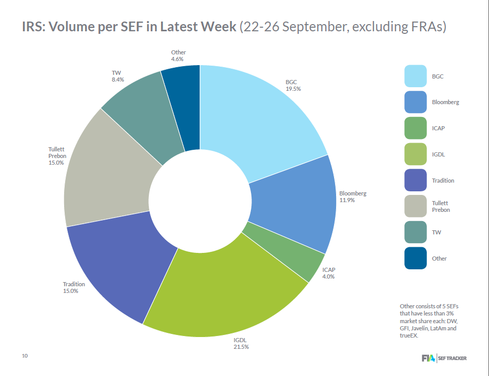

D2D loses volume to D2C

Last week Tabb Group published research showing that on-SEF monthly volumes hit a high of $2.8 trillion in September. But IDB SEFs have been losing IRS market share to client-facing SEF venues, according to Tabb's fixed income research analyst Colby Jenkins, in the firm's release.

Dealer-to-Dealer (D2D) SEFs, which were the first SEFs to go live, enjoyed over 95% of notional volume traded via SEF initially, but they are starting to lose ground to new client-facing D2C SEFs, states the report. The report finds that 44% of activity for USD-denominated rates is transacted through D2C platforms.

Tabb's analyst predicts that for IDB venues, competition will intensify as November 15 approaches, which is the third and final regulatory deadline in the 10-month process of SEF rule implementation.

As the last of the CFTC exemptions for package trades expire on Nov. 15, Cawley anticipates that more volumes such as strategies involving swaps and US. Treasuries will move onto SEFs.

Looking beyond IRS, BGC is keeping an eye on FX becomes made available to clear (MAC), he expects FX to be made available to trade on SEFs in 2015. The SEF rules say that any instrument that is made available to clear in a clearinghouse must be traded on a SEF, he notes.

"You're seeing more trading on SEFs in general and you're seeing more trading in the dealer-to-customer space. That "is a trend you'll see. In November, you'll see the last of the package exemptions roll off. That's going to bring more volumes to SEFs," he said.

Also, IDBs had to contend with Footnote 88, a rule that required foreign dealers who traded with US persons to book a trade on a SEF. Since foreign dealers didn't want to register as a SEF, the CFTC granted exemptive relief to foreign dealers. US subsidiaries of foreign dealers were allowed to book those trades overseas. But if they are a foreign entity trading in the US, they are required to trade on a SEF. But this exemption is due to expire on December 31.

To the extent that the entity trades with another bank, that flow will come onto IDB SEFs, and if the entity trades with a customer offshore, that will come into dealer to customer SEFs, he says. "The overall trend is more business trading on SEFs," he asserts.

Ivy is Editor-at-Large for Advanced Trading and Wall Street & Technology. Ivy is responsible for writing in-depth feature articles, daily blogs and news articles with a focus on automated trading in the capital markets. As an industry expert, Ivy has reported on a myriad ... View Full Bio