08:01 PM

Wall Street IT Salary Survey: Tech Pros Looking for More

More than five years removed from the start of the 2008 financial crisis, the securities industry is starting to see some growth when it comes to IT salaries and demand for highly skilled workers. However, no one expects IT hiring to reach pre-crisis staffing levels anytime soon, as banks are running more efficient technology organizations than they have in decades.

The current market for IT talent is strong and growing, according to 1,254 banking and securities IT professionals who participated in the InformationWeek 2014 US IT Salary Survey: Banking and Securities. Most in demand are individuals with skills and experience in key focus areas of data security, data management and analytics, as well as social media, cloud, and mobile app development.

Finding data scientists and analytics experts is extremely challenging, industry technology leaders have told Wall Street & Technology. Not only do all financial firms want data experts, but companies in all verticals are searching for workers who can crunch data, develop mobile tools, and work on new cloud projects. In other words, competition for these skills is fierce.

[For the Top 10 finding of the 2014 Banking & Securities Salary Survey, visit: 8 Financial Services 2014 IT Salary Trends].

Individuals with very specific and hard-to-find skillsets are finding it easier to make the move to other companies. John Reed, senior executive director for Robert Half Technology, says financial organizations are seeking people who can help them manage data. “Competition is very high and close to zero unemployment. Everyone wants these skills,” he says. “Depending on the specific technology and location, for most of these individuals, income has increased 6 to 8 percent each year, although we’ve seen some double-digit compensation increases year-over year.”

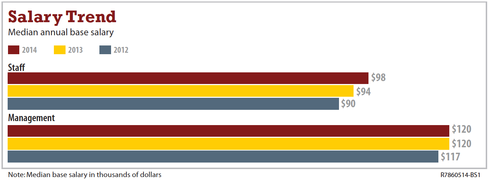

Overall, base salaries have risen consistently over the past several years. 2014 survey respondents revealed that the median base salary for staff climbed 1.4% to $98,000 from 2013 while the median base salary for managers has leveled off at $120,000 since last year. Total compensation -- including bonuses and other direct cash payments received during the previous 12 months -- rose for both groups, a 1.9 percent jump for staff and a 2.6 percent rise for managers.

There’s still a gender gap in financial services, as women in both staff and management positions continue to be paid less. Women in banking and investment firm staff positions received a median of $9,000 a year in bonuses, compared to $5,000 for male staff. In general, more than three-fourths (77%) of IT staff and 86 percent of IT managers expect a bonus in 2014, with bonuses most often tied to personal and corporate performance for both groups.

Bhushan Sethi, financial services people and change leader at PwC, says that because there is less money to go around in bonus pools, financial firms are looking at ways to engage IT employees. “Organizations are looking at guiding employees’ career paths inside technology, maybe into the business, or even with some of their external business partners, giving employees some flexibility in how and where they work, and thinking about what other investments they can make in individuals, whether it be training, sabbaticals, or offering a part-time university course,” he explains.

Robert Half’s Reed notes that savvy leaders and companies are identifying strategies to get people out of their silos. “The data and software and online people are talking. The best way to harness the brainpower of the organization is to have different areas collaborating where they typically don’t do so."

While a majority of banking and investment firm IT staff and managers are satisfied with all aspects of their current positions, 41% of staff and 45% of managers are looking around, either somewhat or actively. Those who are looking seek more pay, more interesting work, personal fulfillment, a better corporate culture, increased job stability and security, a better location -- and more flexibility.

Job flexibility -- whether in location, schedule, or other components of the employment relationship -- has become a hot button for many workers, especially for Gen Y and Millennials. “This group wants feedback and interactions in person, but they also want flexibility,” says PwC’s Sethi. “People want to do things around their lifestyle. It may not equate to working from home, but employees want the flexibility in how, when, and where they work.”

For more on 2014 salary trends in the financial services industry, download the full 2014 Banking & Capital Markets Salary Survey.

Peggy Bresnick Kendler has been a writer for 30 years. She has worked as an editor, publicist and school district technology coordinator. During the past decade, Bresnick Kendler has worked for UBM TechWeb on special financialservices technology-centered ... View Full Bio